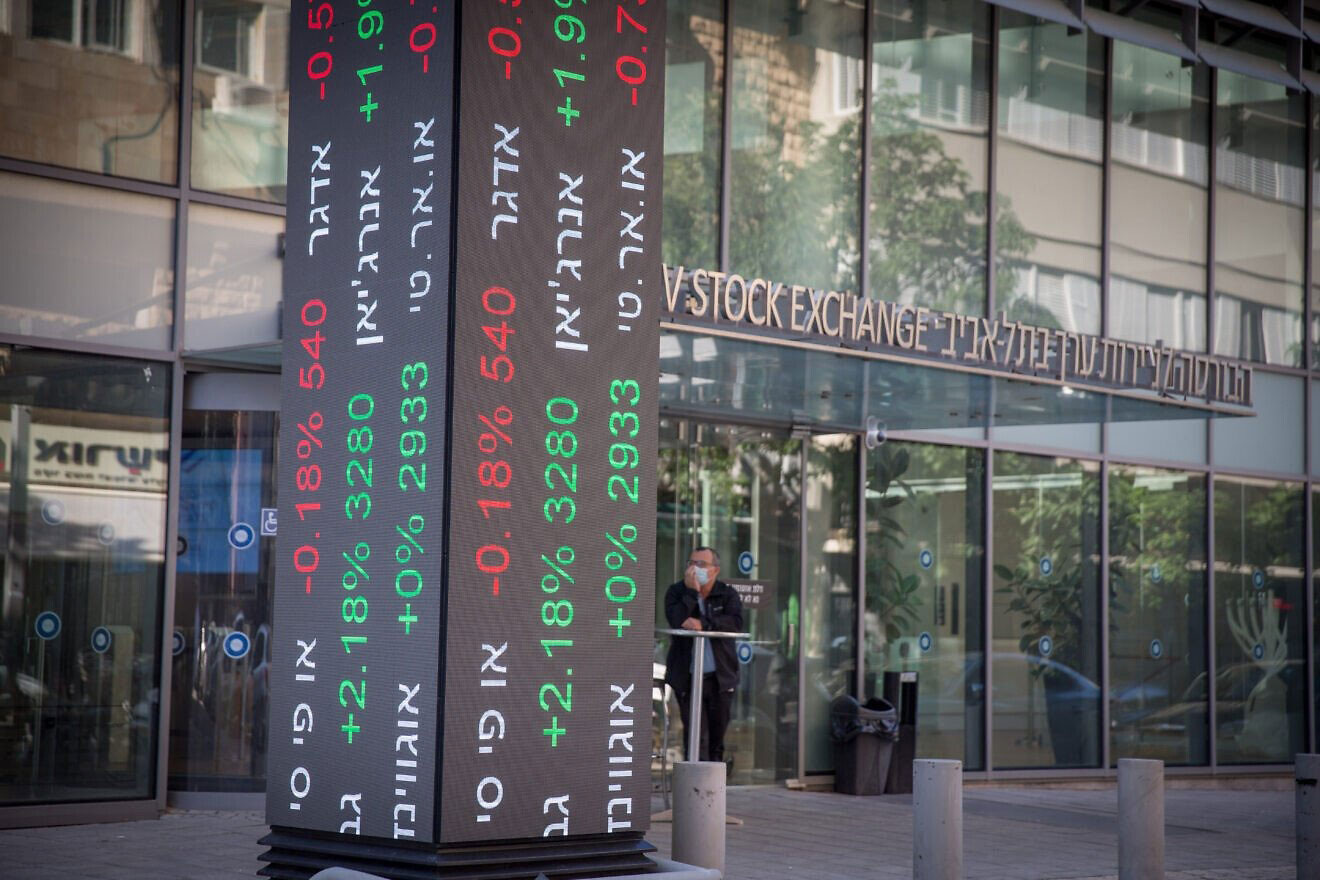

Courtesy of JNS. Photo credit: Miriam Alster/Flash90

The Tel Aviv Stock Exchange, Nov. 29, 2020

(JNS) — The Tel Aviv Stock Exchange (TASE) recorded substantial gains on Thursday, a day after U.S. President Donald Trump announced a 90-day halt to tariff increases that would have affected more than 75 countries, including Israel.

By late morning, the flagship TA-35 Index had advanced by 2.91%, reaching 2,440.66 points, while the broader TA-125 Index climbed 3.01% to 2,476.45 points.

Trump explained that the pause is designed to support ongoing discussions surrounding global trade policies and tariff structures. During this interim period, the U.S. tariff rate will be kept at 10%, except for China, where it is 125%, and on cars and car parts, where it is 25%. The decision was influenced by appeals from various governments seeking to revise their trade arrangements with the United States.

Earlier in the week, Israeli Prime Minister Benjamin Netanyahu met with Trump to address concerns over a proposed 17% tariff on Israeli exports. Netanyahu reaffirmed Israel’s efforts to narrow its trade deficit with the U.S. and to dismantle unnecessary trade restrictions.

The baseline 10% tariff increase on Israeli imports remains in place, but the additional 7% rise is among those the U.S. suspended on Wednesday.

The market’s rally signals a strong investor belief that the easing of trade tensions may lead to more favorable economic agreements between the two nations.